is there a child tax credit for december 2021

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. Removes the minimum income requirement.

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

. Qualifying families will receive half of their credit divided into 6 monthly payments deposited from July to December 2021. The remaining 1800 will be. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

Your newborn should be eligible for the Child Tax credit of 3600. December 10 2021 at 700 am. For children under 6 the amount jumped to 3600.

By August 2 for the August. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. Even if you dont owe taxes you could get the full CTC refund.

The tax credits maximum amount is 3000 per child and 3600 for children under 6. The Democrat Senators are trying to. In addition taxpayers eligible for a child tax credit wont have to.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. These payments were part of the American Rescue Plan a 19 trillion dollar. Increases the tax credit amount.

The 2021 CTC is different than before in 6 key ways. Congress fails to renew the advance Child Tax Credit. Advanced payments of the 2021 CTC will be made monthly from July through December to eligible taxpayers starting July 15.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. There are a number of changes to the CTC in 2021 because of the American Rescue Plan Act of 2021 which President Biden signed into law on March 11 2021. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

As with 2021 monthly payments it appears as if the IRS. To be eligible for the maximum credit taxpayers had to have an AGI of. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Complete IRS Tax Forms Online or Print Government Tax Documents. Eligible families have received monthly payments of up.

If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

How Next Years Credit Could Be Different. Your newborn child is eligible for the the third stimulus of 1400. Yet there are a number of people who can boost their payments for December.

A credit directly reduces your tax bill dollar-for. Among other changes the CTC was increased this. For additional information on the amounts of modified AGI that reduce the 2021 Child Tax Credit see Q C4 and Q C5 below.

The advanced payments will be up to 50 percent of the total estimated credit which is based on information included in eligible taxpayers 2020 tax returns or their 2019 returns if the 2020 returns are not filed and. Child Tax Credit 2022. Get your advance payments total and number of qualifying children in your online account.

Distributing families eligible credit through monthly checks for. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. 150000 or less for married couples filing a.

When the American Rescue Plan Act of 2021 was signed into law on March 11 it temporarily amended the child tax credit for the 2021 tax year. In previous years 17-year-olds werent covered by the CTC. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

The sixth and final advance child tax credit CTC payment of 2021 is being disbursed to more than 36 million families Wednesday the IRS announced. Under the American Rescue Plan Act of 2021 the new Child Tax Credit is a refundable credit worth up to 3600 per qualifying child under 18. In TurboTax Online to claim the Recovery Rebate credit please do the following.

If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit. These changes are an increase from last years Child Tax Credit benefit of 2000. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child.

The American Rescue Plan temporarily boosted the child tax credit just for the 2021 tax year to 3600 for children 5 and younger and 3000 for. It is a partially refundable tax credit if you had earned income of at least 2500. This means that parents or legal guardians of children under 18 could be eligible for a larger credit than they were in 2020 depending on their income.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. In most cases a tax credit is better than a tax deduction. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. Last year the tax credit was also fully refundable meaning that if the credit amount a. For 2022 there would be 12 monthly payments under the Build Back Better plan but the maximums 250 or 300 per child would not change.

The 2021 advance monthly child tax credit payments started automatically in July. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in.

Makes the credit fully refundable. From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17. 75000 or less for singles 112500 or less for heads of household and.

Enter your information on Schedule 8812 Form. To reconcile advance payments on your 2021 return.

The Child Tax Credit Toolkit The White House

2021 Child Tax Credit Advanced Payment Option Tas

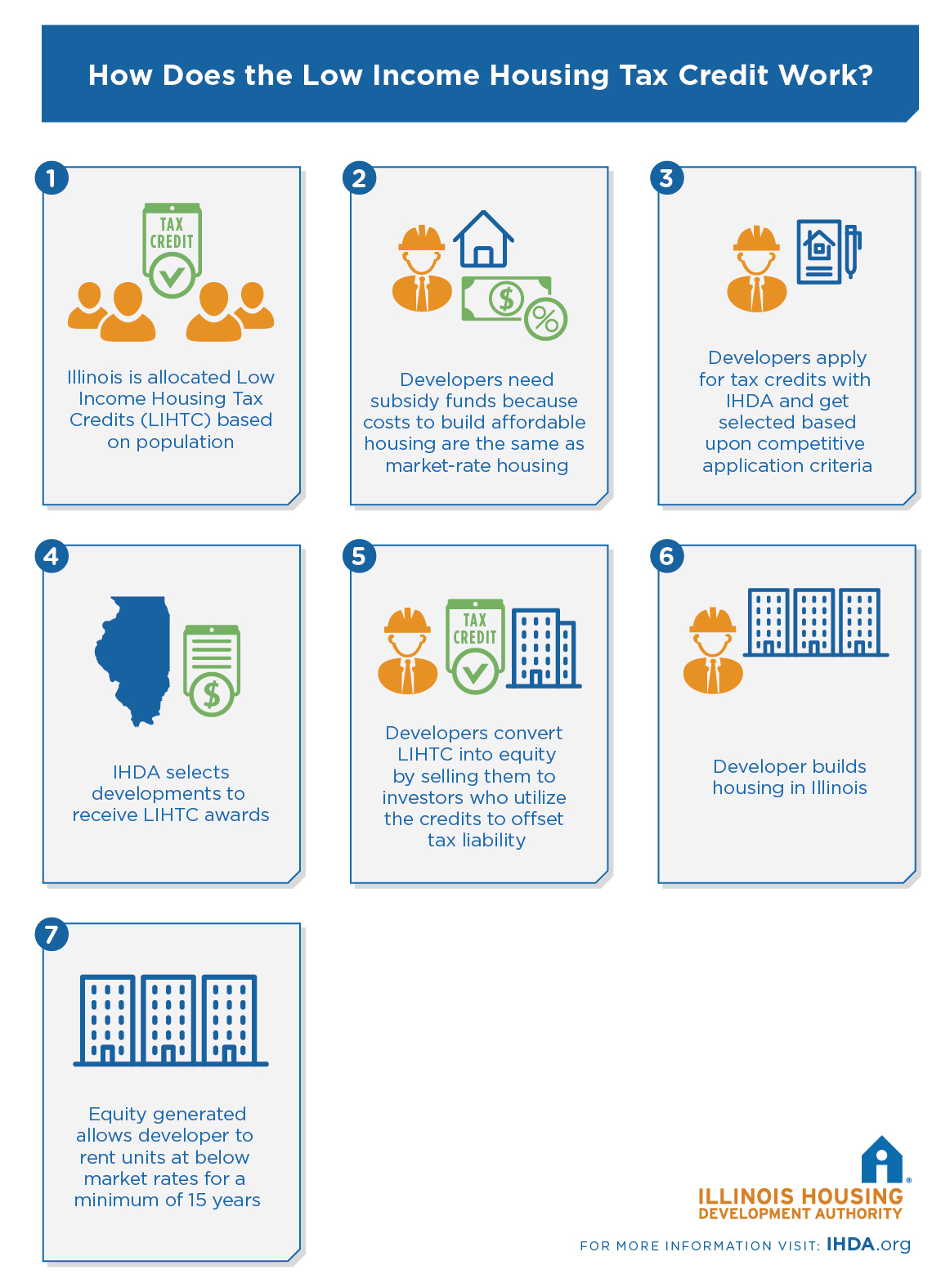

Low Income Housing Tax Credit Ihda

Child Tax Credit Definition Taxedu Tax Foundation

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Child Tax Credit Schedule 8812 H R Block

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

What Families Need To Know About The Ctc In 2022 Clasp

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times